The Un-Carrier isn’t stopping. It won’t as one of the most aggressive brands we know. After making it known to the public it will start selling the Pixel 3 and Pixel 3 XL and maybe the upcoming Pixel 3a and Pixel 4 series, the company is introducing T-Mobile MONEY. Mobile and digital payment solutions are more than a trend. They’re a necessity now because many people prefer to not bring cash around. Such is convenient and safe. People managing their finances on phones are nothing new. It’s about time more businesses get on the game.

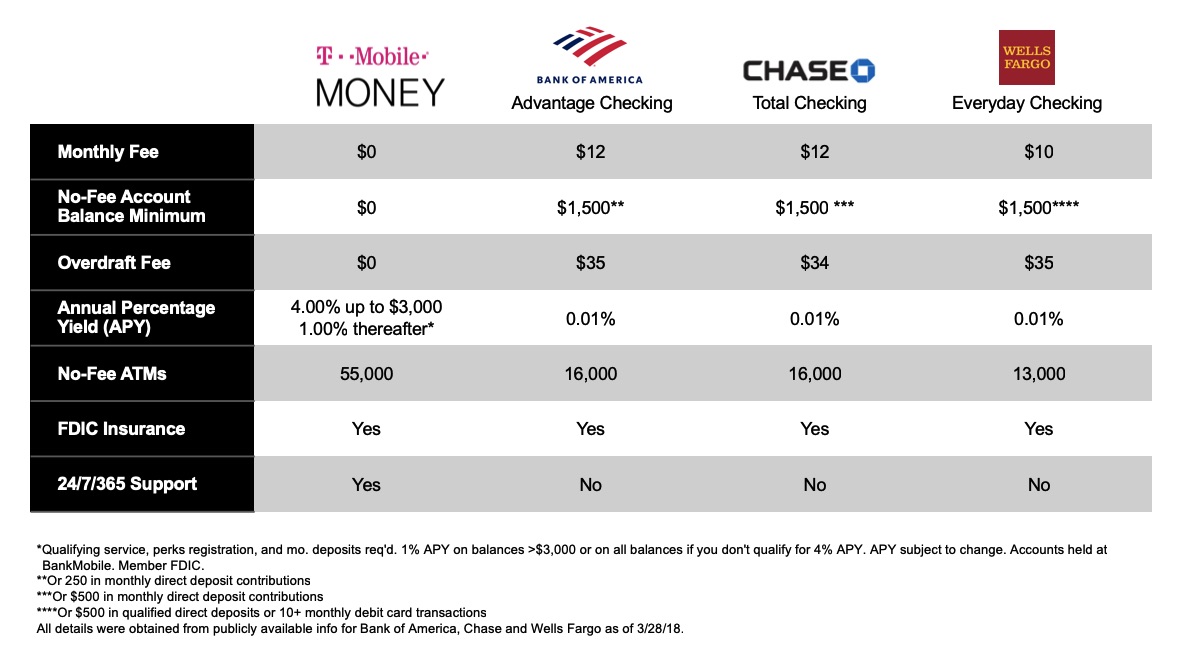

T-Mobile MONEY will be available nationwide in the US. It’s more of a mobile-first checking account that lets you earn interest without any fee. Bank fees are unnecessary and T-Mobile wants to offer that.

The Un-carrier definitely wants to change the mobile game. It doesn’t require many forms or documents. You can open and maintain one right on your phone. It’s offered initially for T-Mobile subscribers. If you save at least $3,000, you can get as much as 4.00% Annual Percentage Yield (APY). Over that amount, you can get 1.00 APY% on every dollar.

Overdrafts and bank fees are common but T-Mobile MONEY doesn’t have them. T-Mobile “saw an opportunity to address another customer pain point” so it introduced the mobile-first and customer-first service. Simply put, T-Mobile eliminates the bank fees when you need to make transactions sans any fee, overdraft, or penalty.

Mobile banking may be new but it’s certainly the way to go. We’re crossing our fingers more banks, financial institutions, brands, and carriers consider the digital platform.

Like any regular banks, T-Mobile MONEY lets you deposit money, pay bills, send a check, make mobile check deposits, pay with a mobile wallet, transfer money, and make payments person-to-person. It’s secure with face ID login, fingerprint, account alerts, and debit card disabling among others.