Smartphone shipments are poised to reach 1 billion units for 2013, according to new research by IDC. The research leo suggests that 1.7 billion devices will be sent out worldwide by 2017, with emerging markets to thank for the boom. Though more units are shipped, the current profit margins may not be realized.

IDC expects that with the increased deliveries will come reduced prices. From 2012 to 2013, shipments increased by 39.3%, but the average price of smartphones was 12.8% lower. That trend is, once again, thanks to emerging markets who don’t — or can’t — spend on luxury items. This paves the way for devices like the Moto G, which is currently on sale.

The biggest growth potential is — and should remain — Latin America, Asia Pacific, and the EMEA region. Each of those areas represent well over 20% growth, with the EMEA representing nearly 30%. Though the research splits Europe from that region, we cobbled it in to align better with other studies we’ve reported on previously.

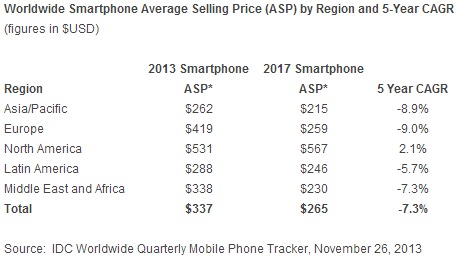

Also of interest is the average selling price, and how it will reflect moving forward. The largest drop will be in Europe, where the pricing is expected to drop a full 9%, or just over 8% if you factor in the Middle East and Africa. Asia Pacific is expected to drop about 8.9%, and the average cost of a handset in Latin America will decrease by 5.7%. North America, however, is expected to see a pricing hike of about 2.1%.

With the pricing sensitivity around the world, and the competition either being proprietary or requiring licensing, Android should continue to see dominance. In emerging markets, Android evices are already making inroads, if for nothing more than basic services like GPS and Email. As an open source platform, it becomes easier for incumbent OEMs to support the platform.