If there’s one segment of the smartphone market that you would expect to suffer during this pandemic, it will probably be the premium market. And according to the latest numbers from Counterpoint’s Market Pulse survey, yes it did decline during this first quarter of 2020 as compared to year on year numbers. The slight good news is that its overall contribution in the global smartphone market remains almost the same. Apple is still the top brand with more than half of the market share, followed by Samsung and Huawei.

Counterpoint defines the premium smartphone segment as those priced more than $400, wholesale. Sales from January – March declined 13% year on year but this is something that has been expected. In terms of percentage of the whole smartphone market, it was steady at 22% in terms of sell-through but in terms of revenue, it was close to 57% of the global market. Apple’s iPhones were of course dominant with a 57% market share followed by Samsung at 19%, Huawei at 12%, Oppo at 2% and Xiaomi at 2%.

Most of the brands experienced decline except for OPPO that grew year on year with 67% and Xiaomi with 10% growth. It’s also the first time that the latter has been able to get into the top 5 in the premium segment. Apple and Samsung dominated all the regions except in China where Huawei reigned supreme. In fact, more than 90% of their sell-through for Q1 came from China. OnePlus had a good showing as well in all the regions except Latina America and China.

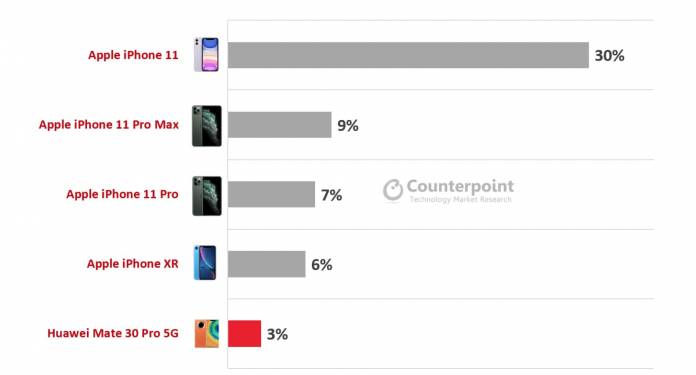

In terms of devices, iPhones got 4 out of the top 5 best-selling models in the premium device category. The Huawei Mate 30 Pro 5G was the only non-Apple device in the top 5 and it is the first time that a 5G smartphone has been in the top 5. We’ll probably see this become more prominent in the next few years as 5G phones actually make up 1/5 of the premium segment in the first quarter.

Counterpoint believes that Apple releasing 5G devices eventually will become a key mover in the growth of the premium segment. Let’s see what effect the pandemic has on this and the global market in general for the second quarter of 2020.