Earlier in January, Google rebranded all payment services into one and decided to call it Google Pay. It showed up first, at least the logo, on some Pixel and Android phones. More features and updates are still in the works and while we’re waiting for the fully ready version, expect the tech giant to work on more improvements and team up with other bigger businesses. For one, Google Pay and PayPal have teamed up together to make mobile payment easier, faster, and more convenient.

PayPal recently made an announcement that it’s deepening its partnership with Google Pay to bring more similar and seamless experience to mobile consumers across the Google ecosystem. This means Google Pay will work hand-in-hand with Google so paying for goods or services will be easier and yet more secure than over. No doubt PayPal is one reliable partner as it’s been focused on dealing with different groups to provide greater choices and flexibility on sending payments. PayPal is supported by most services, storages, and establishments whether online, via mobile apps, or in-store.

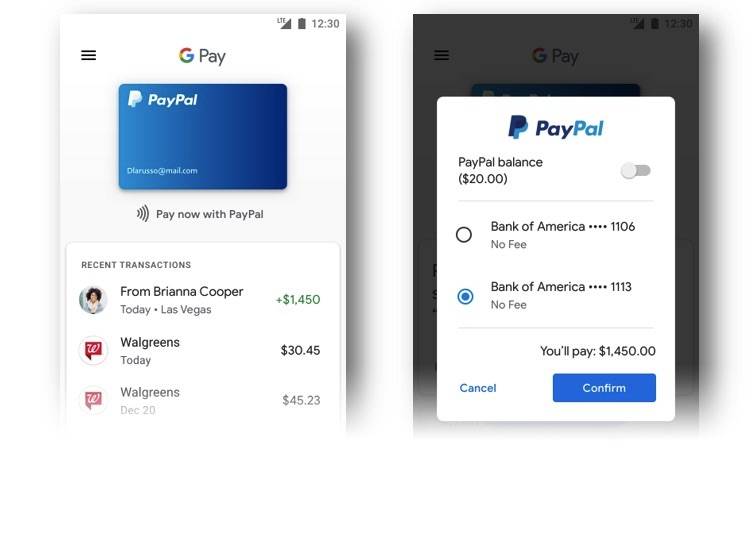

PayPal’s presence on several Google products and services are obvious. Both users of PayPal and Google Pay find it easier to pay via PayPal online, in-app, or in-store with Google Pay and in Chrome mobile. If you have a PayPal account and want to use Google Pay to pay, you can link the two and you can start paying with a simple tap or click. Anywhere PayPal or Google Pay is accepted, you can pay with Google Pay–only after you already linked the two.

On your Google Play account, you can add your PayPal account. This then will enable link PayPal and use it as a payment option for some of the major Google services such as YouTube, Gmail, Google Play, and Google Store. Peer-to-peer payments are also supported.

But why is PayPal preferred again? Security. We can all agree PayPal is more secure compared to direct credit card transactions. Both Google Pay and PayPal have common goals to make mobile payment simpler and faster across most platforms. Another objective is to make the shopping experience more seamless. It’s possible with the security, speed, and flexibility offered by most digital payments.

PayPal’s benefits are a dime a dozen. It can be accessed by all types of payments on almost any platform or device. It offers fast and easy checkout. It’s easy too because of the fewer clicks and fewer screens. For business owners, you can use credit and offer credit to customers as well. Integration of payments in businesses is already tried and tested. And have we mentioned it’s safe and secure?

SOURCE: PayPal