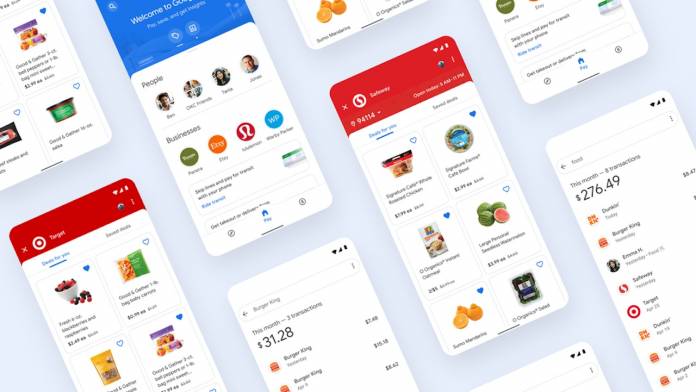

When Google released its overhauled Google Pay service last year, one of the things they announced is that they will offer a mobile-first bank account called Plex. They were supposedly partnering with several banks and financial institutions to offer a bank account with no monthly fees or overdraft charges. But now they have scrapped plans to offer this and instead will be focusing on “digital enablement for banks and other financial services” instead of becoming a provider of banking services.

A Wall Street Journal report says that Google is scrapping those initial plans to partner with financial institutions like Citi and the Stanford Federal Credit Union. The idea for the Plex product was to have a better experience for users when it comes to mobile banking and have an account that is mobile-first rather than mobile also. But a Google spokesperson has now said that they have realized that consumer demand is for “simple, seamless, and secure digital payments” whether it’s for online or in-store transactions.

This follows the departure of Caesar Sengupta who was vice president and general manager of Google payments and was overseeing this project. He left earlier this year and started his own financial tech company called Arbo Works and even recruited some of his team members from Google. While they did not specifically mention this as a reason for scrapping Plex, it probably played a big part in this decision.

Google Pay launched a revamped app earlier this year as well, using aa new codebase originally developed in India. It followed the WhatsApp model of using your mobile number as your identity and also shut down the Google Pay website functionality. It no longer supposed multiple accounts and users needed to create new contact lists again for sending money. Sengupta left before they were able to totally revamp the whole system.

Currently Google Pay is in shambles as some countries are still on the old version while some are in the revamped system already. With this latest development, or rather non-development, it’s unclear what the future holds for the mobile payment service.