While mobile payment platforms seem to be the way to go for a lot of OEMs, there may still be a need for physical cards for a wider variety of purchases. It looks like Google is exploring this particular kind of payment as images have leaked of a Google-branded smart debit card. It will probably be connected to their existing Google Pay system to further expand the capability of that platform. They will reportedly partner with banks first and use the financial institutions’ capabilities before going full-blown into fintech or financial technology.

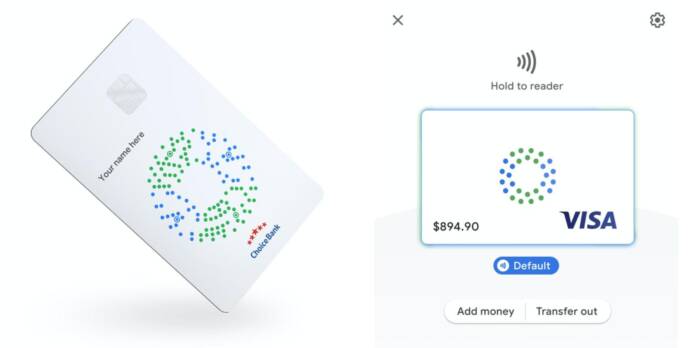

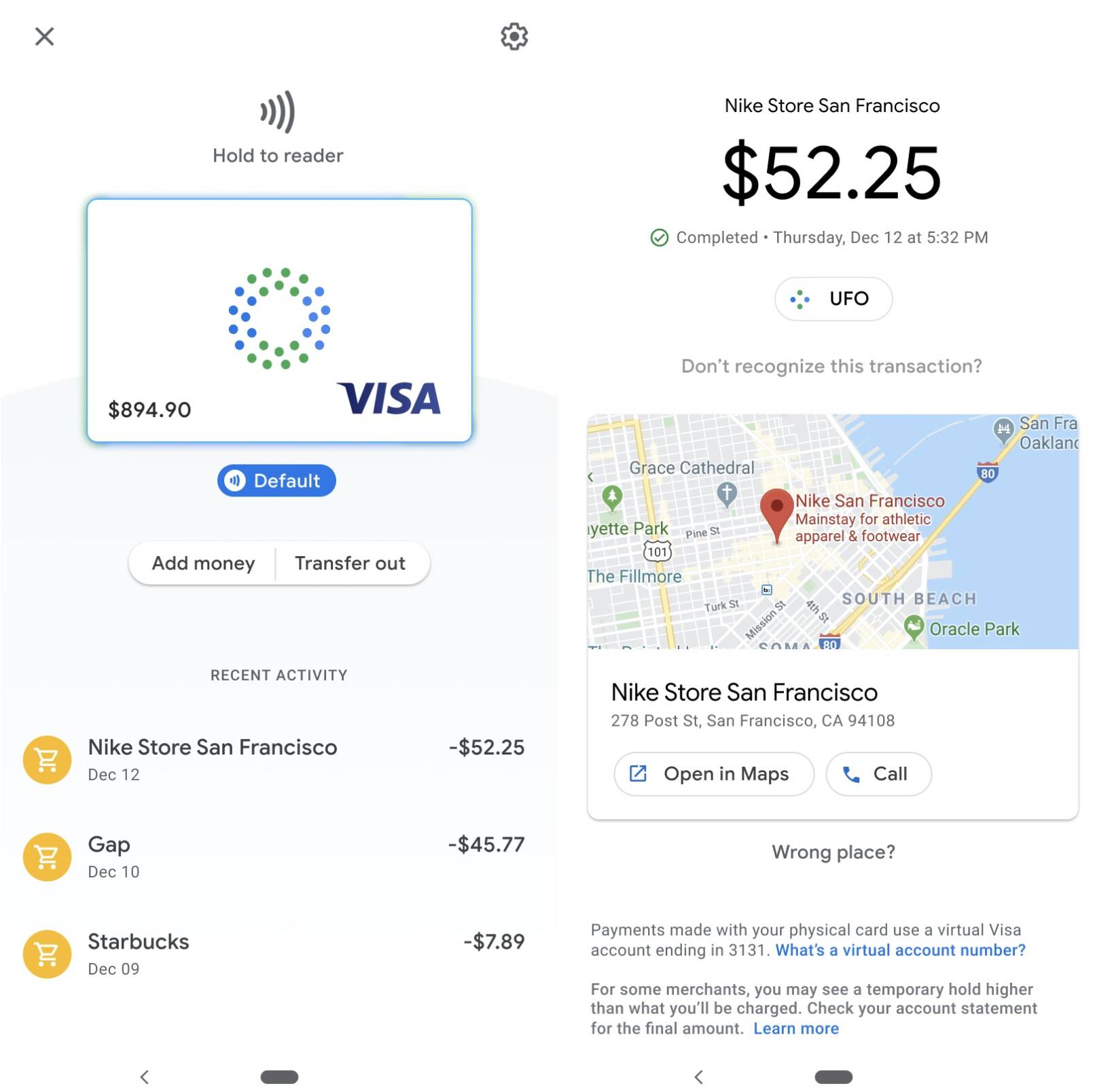

Based on the leaked images, it looks like Google will be working on a branded debit card instead of a full-blown credit card like what Apple did with its Apple Card. The physical card seems to be a Visa card but it’s also very possible that they will be expanding to MasterCard eventually. They are reportedly partnering with Citi and Stanford Federal Credit Union for this experimental project. The card will work as a physical card as well as a tap-to-pay digital card, but it will have a separate virtual card number for online transactions.

What makes this debit card different is that it is “smart” of course. You will be able to track all the purchases you have made, probably through the Google Pay app. It will even leverage other Google products like Google Maps so you can contact a previously visited store in case there’s any problem. In case of lost or stolen cards, you can lock it using the app so whoever finds it will not be able to use it. But otherwise, it functions just like other debit cards too, but only a little more convenient and secure.

While Google did not specifically confirm the leak, they did tell TechCrunch that they are exploring how to partner with banks and credit unions in the U.S. to offer “smart checking accounts” through Google Pay. They mentioned Citi and Stanford Federal Credit Union as their lead partners but there’s no mention of a smart debit card anywhere, although the leaked images seem to be pretty legit.

Hopefully, we get more news soon about this, although in this COVID-19 pandemic environment, physical cards may not be the priority. Hopefully upon launch (if they do launch), they can offer something more to entice people to get the debit card, like cash back offers, discounts, etc. For now, you do have Google Pay to use for online payments, peer-to-peer transactions, and NFC store payments.