If you trust T-Mobile as your carrier of choice, they are assuming that you are most likely to trust them with your money as well, especially if you are tired of “regular” banks and their account fees, maintenance fees, minimum balances, etc. The new product they’re launching is called T-Mobile MONEY and not only will you have the usual online banking experience, but you also get an ATM presence through its partnership with Bank Mobile through Allpoint ATMs.

When you put money in your T-Mobile MONEY account, you automatically earn a 1% Annual Percentage Yield (APY). But if you deposit at least $200 every month and you have a balance of $3,000, that APY will actually increase to 4%. Eligible T-Mobile customers can also receive up to $50 of spending in overdrafts with no fees. You get an EMV chip debit card that you can use at Allpoint ATMs should you need to get your money.

Probably one disadvantage of this new product is that you cannot deposit cash to your account. You will have to get a money order or a cashier’s check and put it in through mobile deposit. Or you can deposit money through another bank and then move it to your T-Mobile MONEY account. Hopefully, in the future, they’ll be able to add easier ways to put money into your account.

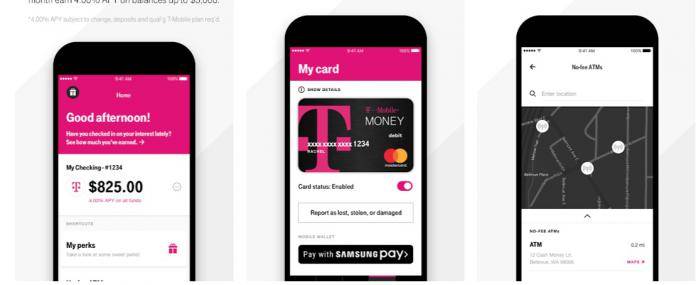

What can you do with your mobile wallet? You can use it to pay for purchases both online and offline through Google Pay or Samsung Pay. You can also use it to pay your bills directly from the app itself. In terms of security, it has multi-factor authentication as well as log-in through Fingerprint Scanner. If you lose your debit card, you can disable it immediately. Plus you get FDIC insurance up to $250,000.

To start your T-Mobile MONEY journey, you can download the app from the Google Play Store for free and start setting it up. Once you already have funds in it, you can start using it for purchases after linking to a mobile payment gateway. Hopefully, this new venture will be more successful than its previous attempt four years ago with Mobile Money.

SOURCE: T-Mobile