While the rest of UK is waiting for Android Pay, Samsung Pay is also busy revving up its global expansion engines. We have no idea how Apple Pay is doing but according to an estimate, it already has 12 million monthly users since the program was launched in October of 2014. That’s more than a year compared to Android Pay which was announced in September 2015 but now with about 5 million users.

Samsung Pay also attracted 5 million users. It shows a faster growth rate compared to Apple Pay but there’s still a lot of room for improvement. The number could be even higher if the service is available on older Galaxy phones. Right now, Samsung Pay only works on the Samsung Galaxy S7, Galaxy S7 edge, Note 5, Galaxy S6, and S6 edge/S6 edge+ while Apple Pay works on the latest iPhone 6 variants plus the Apple Watch with iPhone 5 and some older models. Meanwhile, Android Pay works on most Android devices so Google’s own mobile payment system has an edge.

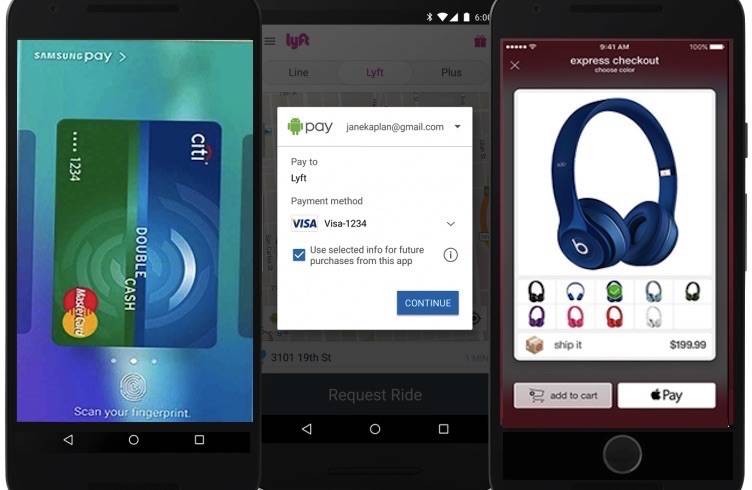

So it’s Apple Pay vs Android Pay vs Samsung Pay. Google’s Android Pay may have arrived earlier as Google Wallet but it’s only now that more people are using the service. The rebranding did Google good. The competition is now tighter than ever among the three but in reality, mobile payment has yet to be a standard. Cashless payment is nothing new but making purchases from a phone is still not widely accepted. We may see those millions of registered users but compared to the hundreds of millions of mobile devices around the world, the numbers are smaller.

We’re not forgetting the fact that Samsung Pay was used in over $500 million worth of transactions in the United States. That’s still a lot of money but more establishments, retailers, and mobile users have yet to accept mobile payments. Samsung Pay is supposed to work everywhere but we don’t know how many Android users own the latest Galaxy phones.

We don’t think learning to use mobile payments is difficult but it takes patience and even trust that payments are safe and secure. Mobile wallets are certainly helpful but it takes some encouraging and confidence before people jump in. There is still hope though as more and more banks and retailers are embracing the idea. We’re positive about the mobile payment method and we’re expecting more mobile wallets will be opened this year.

VIA: Bloomberg

I don’t know why Samsung creates their own apps instead of using Google’s own apps like Android Pay. Google did not like Samsung doing this.

Google Wallet had existed years before Apple pay, but mobile payments did not take off until Apple pay came out as Google did not highly promote it.

In most cases I’d agree but the implementation with MST makes Samsung Pay the better option since it can be used virtually anywhere

they face competition vs themselves as my credit card doesnt work with samsung pay but it has been working with google wallet/android pay for over a year.